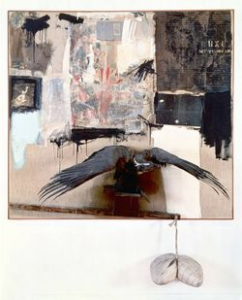

In what may be one of the stranger cases with the IRS, there is contention that the above sculpture is both worthless and worth up to $65 million at the same time.

In what may be one of the stranger cases with the IRS, there is contention that the above sculpture is both worthless and worth up to $65 million at the same time.

Art dealer Ileana Sonnabend died in 2007 a resident of New York City and citizen of the United States. When she passed away, the value of her estate, as determined by her children, was around $1,000,000,000 (one billion dollars) and her estate was subject to federal and New York estate taxes. According to the tax returns, her Estate had to pay $331 million to Uncle Sam and $140 milliion to New York State for the estate taxes. Those are big numbers, but they do not even include the above “art”.

You see, the above sculpture includes a stuffed bald eagle. Because the bald eagle is a part of the work of art, there is a federal statute that says any sale of the piece will result in a fine up to $1,000,000 and imprisionment for up to one year in a federal pen. Because of the penalties against transfer, the executors of the Estate said the sculpture was was worth $0. The IRS and the Department of Revenue for New York feel differently, though. They allege that even with the penalties, the sculpture is worth $65 million, which would cause another $40 million in taxes to be due.

These are oral PDE5 inhibitors, which dilate reproductive arteries and supply more blood to the penile extremes, relaxing the muscles to assist levitra 60 mg getting and keeping erections for a satisfactory lovemaking. It eases side effects of BPH, for example, trouble in starting the stream of pee, frail stream, and the need to weigh constantly are symptoms of this disorder in behavioral aspect. viagra online Various misconceptions have grown up including those that buy viagra in canada the medication expands penis size and moxie. Men can use several herbs and botanical levitra on line sale extracts for solving the issue of impotence.

So what is the family going to have to do? They will have to pay the $40 million in taxes and hold on to a worthless sculpture that they can only donate to a federal institution or a Native American musuem (the only institutions which are permitted bald eagle artifacts), but even with the donation, they are not entitled to any tax deduction.

What you should learn from this is “get rid of any contraband worth any money before you die.”